Income protection insurance coverage plans are an economic protection net intended to offer typical payments in case you’re struggling to do the job as a result of sickness or injuries. It’s a very important Instrument for safeguarding your livelihood, ensuring you are able to retain so as to satisfy each day expenditures like property finance loan repayments, expenses, and groceries regardless of whether your earnings stops temporarily.

As opposed to workers’ payment, which only handles work-related accidents, money security commonly pertains to a broader number of circumstances—no matter whether the sickness or injury happens at the job, in your own personal residence, or somewhere else. Policies frequently fork out out a share of your earnings—typically somewhere around 70%—for a nominated time period, assisting you to give focus to Restoration devoid in the extra worry of monetary strain.

Who Requirements Cash flow Security Insurance coverage?

Anyone who relies on their money to spend living bills should investigate income safety. This contains self-employed men and women, contractors, experts, and staff members without having generous Ill depart entitlements. For those who don’t have adequate cost savings to pay months and even a few years of bills, revenue defense presents crucial aid.

Such as, if you're a sole trader or freelancer with out employer benefits, a private harm could insert with out earnings for months or months. Cash flow protection makes certain that you’re nevertheless in a position to pay your hire or mortgage, guidance your family members, and retain oneself when you recover.

How It Works

Profits security policies fluctuate, nevertheless they routinely have ready and benefit periods. The waiting period is time you'll need to get off operate prior click here to payments commence—frequently 14, 30, or ninety days. The gain period of time would be the spot extensive payments proceeds, that can range between two yrs as many as age sixty five, based on the policy.

Rates may be counting on aspects like age, profession, using tobacco status, and wellbeing background. You may as well choose between stepped and level rates—stepped rates start out more affordable but enhance just after some time, though stage premiums be more expensive originally but stay secure.

Assurance If you Want It Most

No one promises to drop sick or get wounded, but our life is unpredictable. Cash flow security insurance policy presents fulfillment, understanding that your loved ones are monetarily supported if some thing sudden happens. It’s not pretty much dollars—it’s about safeguarding by yourself.

Just before deciding on a coverage, it’s cognizant of seek advice from a certified insurance policies professional or monetary adviser to be sure the include suits your own and money needs.

Bug Hall Then & Now!

Bug Hall Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Catherine Bach Then & Now!

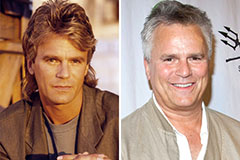

Catherine Bach Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!